Respondents’ expectations for gen AI’s impact remain as high as they were last year, with three-quarters predicting that gen AI will lead to significant or disruptive change in their industries in the years ahead. They are the ones tracking, analyzing, and auditing the company’s https://www.accountingcoaching.online/what-are-different-types-of-ledgers/ income and expenditures. They also have a key role in planning, decision-making, and forecasting, based on their ability to accurately estimate the cost of future projects. In summary, there are many ways sustainability teams can add value in a regulatory context.

Gen AI adoption is most common in the functions where it can create the most value

Since accounting principles differ around the world, investors should take caution when comparing the financial statements of companies from different countries. The issue of differing accounting principles is less of a concern in more mature markets. Still, caution should be used, as there is still leeway for number distortion under many sets of accounting principles. When accounting principles allow a choice among multiple methods, a company should apply the same accounting method over time or disclose the change in its accounting method in the footnotes of the financial statements. Accounting principles are the rules and guidelines that companies and other bodies must follow when reporting financial data.

Managerial functions

Accounting is used by business entities for keeping records of their money or financial transactions. As time goes by, you may find yourself wanting to create a new line item for each transaction. However, doing so could litter your company’s chart and make it confusing to navigate. One of the most important managerial functions of accounting is to plan the budget for income and expenses based on what will happen in the future. Businesses interpret and evaluate financial data derived from financial statements for a variety of purposes. Such financial data helps define an organization’s ability to repay debts, profit-making capacity, work efficiency, accountability, etc.

What Are the Responsibilities of an Accountant?

Source documents include cash memo, purchase invoices, sales invoices, property transfer papers and written agreements, etc. Unfortunately, no objectively verifiable method has been developed for universal application. So, one of accounting’s most important jobs is to stop fraud and mistakes in the organization.

Even though the company won’t pay the bill until August, accrual accounting calls for the company to record the transaction in July, debiting utility expense. For example, imagine a company receives a $1,000 payment accounting for a capital lease for a consulting job to be completed next month. Under accrual accounting, the company is not allowed to recognize the $1,000 as revenue, as it has technically not yet performed the work and earned the income.

- Financial scams and frauds in accounting practices have drawn attention of the users of the accounting information supplied by business enterprises.

- There are several types of functions fulfilled by the accounting department within a business.

- In the other example, the utility expense would have been recorded in August (the period when the invoice was paid).

- Respondents most commonly report meaningful revenue increases (of more than 5 percent) in supply chain and inventory management (Exhibit 6).

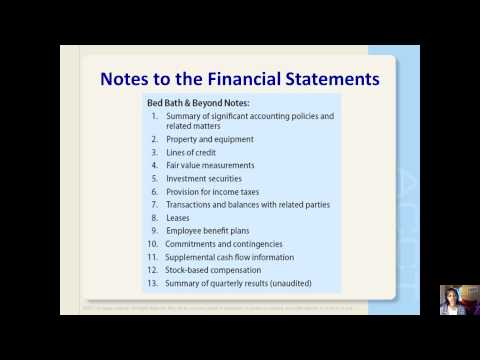

To find out the results of a business, the information relating to the cost of the products and revenues from the products is collected. Then the costs and revenues are compared to find out the profit or loss of the business. If volume of sales of the products is high and the number of transactions of the business is very high, it is impossible to keep all these transactions in the mind of a businessman. The basic objective of accounting is to provide the desired information to the owner as well as to all other interested parties i.e. investors, creditors, employees, financial institutions, government etc. According to this principle, the financial statements should convey information and not conceal it. Because of the principle of full disclosure, companies append notes to their financial statements.

The financial statements of most companies are audited annually by an external CPA firm. Many sustainability professionals are just starting to learn about the types of documentation and controls they’ll need to perform assurance. Some teams are endeavoring to learn about this through trial and error, but internal audit will be able to provide much clearer insight into this maturity. These teams can https://www.accountingcoaching.online/ quickly recommend ways to improve reporting integrity throughout the sustainability reporting process. In addition, internal audit can reduce redundancies by integrating sustainability workstreams into areas overseen by internal audit. This includes assessing materiality of sustainability topics through an enterprise risk process and leveraging financial reporting systems to better track data flows.

However, not all workplaces might feel comfortable with committing to remote working in the long term. Reports by ReportLinker and Statista both say that the value of the outsourcing industry could grow as much as $75 trillion between last year and 2027. Granted, that applies to far more than just the financial and accounting sector. Still, accounting has been projected to see a potential growth of $56.6 billion between 2020 and 2027, which is enough to confirm that this is a trend worth considering for your own operation. Add in the potential for an international law applying to your business, and the potential for a cataclysmic error increases.

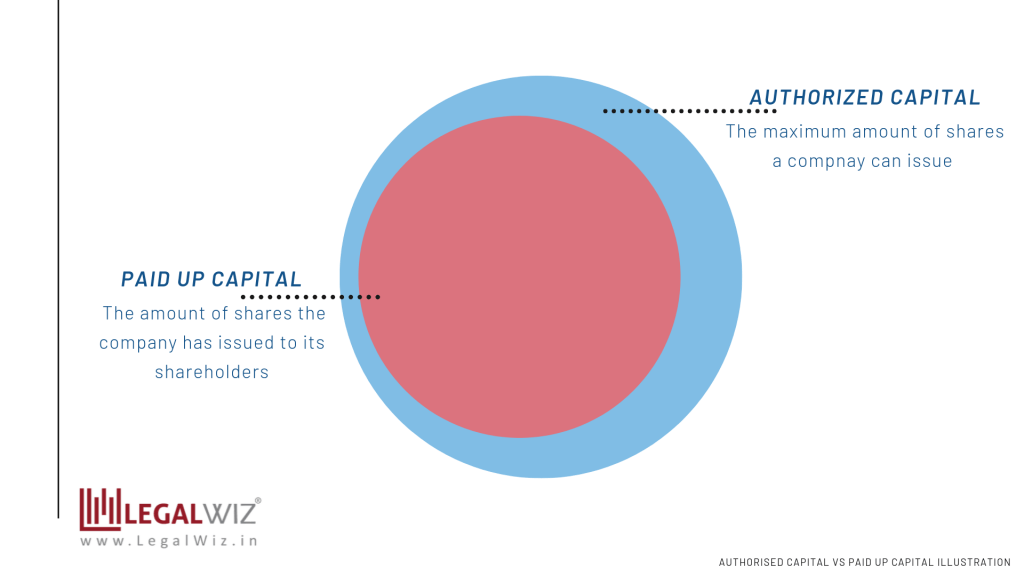

Organizations can leverage frameworks like TCFD and the GHG Protocol, which provide all the tools needed for companies to meet reporting obligations. In the case of Limited Liability Companies, the Cash Flow Statement is also prepared. The ultimate goal of any set of accounting principles is to ensure that a company’s financial statements are complete, consistent, and comparable. Financial accounting is dictated by five general, overarching principles that guide companies in how to prepare their financial statements.

This function reports the financial workings of the company and ensures that all local, national, and international compliance regulations are adhered to in all financial transactions. A balance sheet reports a company’s financial position as of a specific date. It lists the company’s assets, liabilities, and equity, and the financial statement rolls over from one period to the next. Financial accounting guidance dictates how a company records cash, values assets, and reports debt. Because of that, financial accountants have to ensure that income statements, cash flow statements and balance sheets comply with the Generally Accepted Accounting Principles (GAAP) standards.

Therefore, it is necessary that proper accounts should be maintained to compute the tax liability of the business. Accounting is very useful in the determination of the profit and loss of a business and showing the financial position of the business. The provisions of various laws such as Companies Act, Income Tax and GST Acts require the submission of various statements, i.e., annual account, income tax returns and so on. Financial information should be presented in a simple and easy way so that the users i.e. investors, debenture holders, employees and government officials can understand it easily.

The primary functions of an accounting system are to track, report, execute, and predict financial transactions. Sustainability teams may have some familiarity with third party assurance, but likely not to the extent needed to meet new regulations. Understanding the documentation needed will help inform where there are gaps and what needs to be enhanced.

Companies must also provide financial information to local, state, and federal taxing agencies, including the Internal Revenue Service. According to the world’s most successful investor (and third-richest individual), Warren Buffett, the best way to prepare yourself to be an investor is to learn all the accounting you can. Management accountants provide information and analysis to decision makers inside the organization in order to help them run it. Financial accountants furnish information to individuals and groups both inside and outside the organization in order to help them assess its financial performance. Financial analysts use this information to make informed decisions and recommendations.

Managerial accounting uses operational information in specific ways to glean information. For example, it may use cost accounting to track the variable costs, fixed costs, and overhead costs along a manufacturing process. Then, using this cost information, a company may decide to switch to a lower quality, less expensive type of raw materials. A cash flow statement is used by managed to better understand how cash is being spent and received. It extracts only items that impact cash, allowing for the clearest possible picture of how money is being used, which can be somewhat cloudy if the business is using accrual accounting.