Also, look out for the ease of setup, the learning curve, user interface, third-party integration, and quality of customer support. As is frequently the case, many accountancy packages come with the benefit of a free trial, so dip into our best accounting software guides and reviews and, perhaps, check them out for yourself. Therefore, if you’ve got staff that need to access an accounts package this works out as a good alternative. Equally, the Xero Early package is ideally suited to very small businesses, so there’s a package to suit all. Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations. Consider these factors when deciding which free accounting software is best for your business.

Best for fast onboarding: Sage Business Cloud Accounting

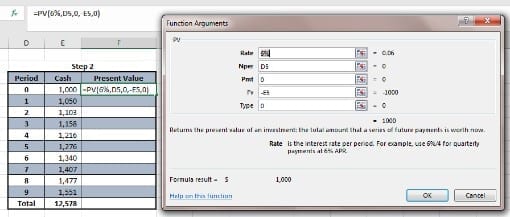

The platform has end-to-end accounting resources to handle the more monotonous, frustrating elements of this side of your business — including invoicing and raising sales orders. The program also has a client portal to help you seamlessly connect with your present value calculator customers. Zoho Books is a robustly featured accounting solution tailored to help small businesses. Its free plan is restricted to organizations generating less than $50,000 in annual revenue, but if you qualify, Zoho Books can cover a lot of your bases.

What are the most common ways business owners pay themselves?

However, while it has many strong bookkeeping features, it is also more difficult to use compared to the other software in this guide. Most of the better features for A/P—such as creating bills and establishing recurring billing—are locked in higher plans. Integrations are also limited in the free plan, but some users may find it more than enough.

QuickBooks Online

You and the rest of your financial team can jump on your account to check numbers and enter information, free of charge. Paid plans start at $15 per month, billed annually, and offer features that include multiple users, bulk updates, timesheets and sales tax tracking. Square Online is an easy to use ecommerce platform fitted with all the bells and whistles for setting up an online store.

Why You Can Trust Fit Small Business

- All the different tools in OneUp were easy to configure, and populating templates for invoicing and inventory orders feels effortless.

- While adequate reporting is a necessity, actionable insights are actually what fuels business decisions.

- The simplest bookkeeping software to use is Zoho Invoice, an extremely user-friendly invoice, billing, and completely free online bookkeeping software.

- The Forbes Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence.

Wave is free for all businesses, while Zoho Books’ free version is limited to companies that make less than $50,000 in annual revenue. The best free accounting software should help track income and expenses, offer banking features in the free tier, and provide additional scalability with paid plans. Free accounting software should come with most of the features you’re looking for, and if it doesn’t, it’s probably worth subscribing to a paid product instead. While you’re unlikely to find features like advanced reporting, job costing or mileage tracking, a handful of products still generate basic double-entry accounting reports and support unlimited invoicing.

The appeal of FreeAgent is mainly due to its affordability factor, with a range of accounting tools on offer for just a few dollars a month. Another benefit of various paid and free QuickBooks https://www.online-accounting.net/what-is-a-suspense-account/ alternatives is that most of them are cloud-based management tools. This means that the software is hosted online and can be accessed from anywhere with an internet connection.

Our partners cannot pay us to guarantee favorable reviews of their products or services. Wave Accounting free accounting software is best for businesses that want an easy-to-use accounting software. GnuCash free accounting software https://www.simple-accounting.org/ is best for businesses that need to track investments and want software that’s compatible with Linux. Xero also syncs with more third-party apps than QuickBooks Online—including more than a dozen payroll platforms.

One of the primary things any new user should consider is how easy a product is to use. Whatever your reason for seeking out alternatives, here are a few things you should pay close attention to while searching for a QuickBooks Online replacement. Square Invoices is a great choice for almost any small business—from freelancers to small teams that need time cards to track hours.

You can start a timer from within the mobile app to log hours spent on a particular project or sync data from tools like Asana and Trello. To find startup accounting software that will best serve your business at any stage, consider scalability as well as strong customer support. You will also want to choose software that uses the accrual basis accounting method for recording transactions. Accounting software helps you track how money moves in and out of your small business.

Its retail solution, for example, includes CRM, inventory management and marketing features to integrate with its accounting platform. But its nonprofit solution includes tools for managing records and scheduling events and even includes a donation portal. And because it’s a cloud-based system, you’ll be able to access your real-time accounting and other business data on the go from anywhere.

We selected it as the best for businesses processing infrequent transactions because while its rates are transparent and predictable, they aren’t the lowest on the market. You can offer your customers flexible payment options, however, including buy now, pay later (BNPL) and ACH processing. Square Invoices also integrates with other Square products, such as Square POS and Square Payments.

If you’re planning to go with this platform, it’s best to set some time for the setup process. We recommend checking out Wave or Zoho Books if you want integrations with third-party software. GnuCash has a spreadsheet-like dashboard, which shows a list of your accounts, income, and expenses. The dashboard looks a bit outdated, and it may be difficult to navigate, especially if you’re used to cloud-based software.